Office of Information and Regulatory Affairs: Federal Regulations and Regulatory Reform under the Obama Administration

From: Bastiat Institute

Mr. Chairman and Members of the Committee:

Thank you for inviting me to testify today. My name is Richard Williams. I am an economist and the Director of Policy Studies at the Mercatus Center, a 501(c)(3) research, educational, and outreach organization affiliated with George Mason University.[1] For more than three decades, I have worked on rulemaking and regulatory analysis, first as an analyst at the Food and Drug Administration (FDA), then as a supervisor of all social science analyses at FDA’s Center for Food Safety and Applied Nutrition. I also worked for a short time at the Office of Information and Regulatory Affairs (OIRA) in the Office of Management and Budget (OMB) reviewing rules from other agencies.

CONTROLLING THE EXECUTIVE BRANCH

For nearly 70 years, presidents have recognized the difficulty of managing regulatory agencies. Harry Truman complained: “I thought I was the president, but when it comes to these bureaucrats, I can’t do a damn thing.”[2] During the last year of his presidency, Jimmy Carter commented that, although he knew from the beginning that “dealing with the federal bureaucracy would be one of the worst problems [he] would have to face,” the reality had been even “worse than [he] had anticipated.”[3]

So why is it so difficult for a president to manage federal agencies? After all, the economic executive orders have the force and effect of law on federal employees and instruct agency heads on the major components of analysis they should use for decision-making. Moreover, agency heads are appointed by, and presumably accountable to, the president. On the other hand, there are about 277,000 employees in 26 executive branch agencies, most of whom are career staff who see presidents come and go. Extensive research on the behavior of regulatory agencies shows how federal employees focus more on the welfare of their agency and less on the president’s agenda. Other than career economists, few working on federal regulations pay attention to benefit-cost analysis or other aspects of regulatory analysis unless it is absolutely necessary.[4] In fact, agencies have a lackluster record in the analysis of either benefit-cost trade-offs or risk-risk trade-offs.[5]

With these factors in mind, every president since Ronald Reagan has relied on OIRA as a regulatory gatekeeper. OIRA’s primary duty is to enforce the presidential economic executive orders, which have barely changed since Reagan’s Executive Order 12291. In doing so, OIRA labors in relative obscurity and, over the years, has produced a record of mixed results.

PRESIDENTIAL PROMISES

Like his predecessors, President Barack Obama has defined the quality standard for rulemaking by executive order. In January 2011, the president said, “Sometimes, those rules have gotten out of balance, placing unreasonable burdens on business—burdens that have stifled innovation and have had a chilling effect on growth and jobs.”[6] In that same month, the president issued Executive Order 13563, which states –

Our regulatory system must … take into account benefits and costs, both quantitative and qualitative. It must ensure that regulations are accessible, consistent, written in plain language, and easy to understand. It must measure, and seek to improve, the actual results of regulatory requirements.[7]

OIRA Administrator Cass Sunstein, charged with overseeing this order, likewise has stated –

Since I was confirmed in September, OIRA has devoted special attention to working with agencies in three areas: promoting open government, improving regulatory analysis, and improving disclosure policies and increasing simplification. The unifying goal is to ensure that regulation is evidence based and data driven and that it is rooted in the best available work in science (including social science).[8]

So what does the record say about these efforts? As past presidents and administrators have discovered, setting standards for transparency and quality analysis is one thing—achieving agency compliance with those standards is another.

THE RECORD

As a measure of regulatory quality, many point to OMB’s annual report to Congress on the benefits and costs of federal regulations and unfunded mandates. The first report issued in 1997 estimated annual benefits at or greater than $298 billion and costs at $279 billion.[9] OMB’s reports have consistently shown benefits exceeding costs for the last 15 years.[10] Because of this, some regulatory scholars have argued that no institutional regulatory reforms are necessary. For example, one prominent scholar argues –

…all indications are that the rules being developed by Executive Branch agencies generally meet the “benefits justify costs” standard of the Executive Order. For example, in OMB’s 2010 Report to Congress, OMB included data on the cost ($43–$55 billion) and the benefits ($128–616 billion) of major rules issued by Executive Branch agencies over the most recent ten-year period (FY 1999–2009). Even if one uses the highest estimate of costs and the lowest estimate of benefits, the regulations issued over the past ten years have produced net benefits of $73 billion to our society.[11]

This argument, however, does not address the question of whether or not these reports are accurate and reliable. There are several reasons to suspect they are not.

- The agencies have a monopoly on analysis.

The estimates used in OMB’s report are prepared by the agencies themselves, which means that the agencies are analyzing their own decisions. Research shows that agencies often make decisions early in the regulatory process and agency economists are pressured to make their analyses support those decisions.[12] In fact, agencies do an overall poor job of preparing economic analysis for new rules. Since 2008, the Mercatus Center at George Mason University has conducted a project known as the Mercatus Regulatory Report Card (Report Card) that evaluates federal agencies’ economic analyses, called Regulatory Impact Analyses (RIAs), for economically significant rulemakings. Rulemakings evaluated by the Report Card receive a score ranging from 0 (no useful content) to 5 (comprehensive analysis content with potential best practices) on questions based on requirements imposed under Executive Order 12866, as well as RIA guidelines laid out in the OMB’s

Circular A-4.

Unfortunately, the Report Card findings have not been reassuring. Agencies consistently do a poor job on economic analysis. The average Report Card score was 28 out of a total of 60 points for the period 2008 to 2010.[13] That’s an F. In 2011, the average score is a disappointing 29. Analysis by other researchers in the past confirms the poor quality of federal regulatory impact analyses.[14]

Research indicates there are no significant differences in the quality of economic analysis across administrations, suggesting the problem is institutional, rather than just a case of a few bad apples. Some of the most problematic areas the Report Card data identify are a failure to define the systemic problem or market failure the agency sought to solve through regulation, a lack of consideration of serious alternatives to the regulation being proposed, and a failure to set forth procedures to track results of the regulation once it has been implemented.[15]

Another area of concern is the underlying science supporting the economic arguments. For example, one way to support decisions is to find new benefits. For rulemakings proposed in the last few years, many of the benefits are either co-benefits (primarily reductions in PM 2.5 included in clean air rules targeted at other pollutants), or benefits based on assumptions that individual preferences are incorrect (people are not buying energy-efficient cars or appliances to the extent that the government believes they should).[16]

Another way to generate excessive benefits is by using conservative assumptions in risk assessments. A recent report by the National Research Council (NRC) of the National Academy of Science raises the point that there may be systemic problems with some risk assessments –

Overall, the committee noted some recurring methodologic problems in the draft IRIS assessment of formaldehyde. Many of the problems are similar to those that have been reported over the last decade by other NRC committees tasked with reviewing EPA’s IRIS assessments for other chemicals. Problems with clarity and transparency of the methods appear to be a repeating theme over the years, even though the documents appear to have grown considerably in length… .

…The committee found that EPA’s draft assessment was not prepared in a logically consistent fashion, lacks clear links to an underlying conceptual framework, and does not sufficiently document methods and criteria used to identify evidence for selecting and evaluating studies.[17]

A recent examination of United States Department of Agriculture’s catfish inspection rule also found issues with the science behind the benefits analysis. In 1991, ten cases of Salmonella Hadar had been possibly associated with catfish consumption. However, the risk assessment multiplied that evidence into a finding that there were approximately 2,500 cases per year.[18]

Early on, the Government Accountability Office noted the problems with the OMB reports –

…the experts said that OMB’s 1998 upper-bound estimate of total regulatory benefits was questionable or implausible and they were particularly critical of OMB’s unadjusted use of EPA’s Clean Air Act benefit estimate; (8) they also said that OMB should not have simply accepted agencies’ cost and benefit estimates for the major and economically significant rules, and should have provided new regulatory reform recommendations; (9) however, the experts said they understood why OMB could do little to discuss the other statutory requirement regarding the indirect regulatory effects on particular sectors; (10) overall, they said OMB should have been more than a clerk, transcribing the agencies’ and others’ estimates of costs and benefits;… [19]

2. OMB’s reports to Congress are not representative of all rules.

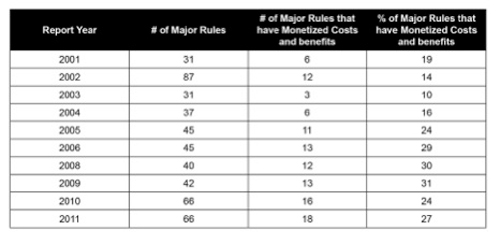

The estimates presented in OMB’s reports are a tiny fraction of all final rules issued in any given year. For example, in 2010 agencies issued 3,083 final rules but only 16 had quantified benefits and costs (or about ½ of 1 percent). OMB reported the sum of benefits and costs for those 16 rules as the total costs and benefits for all final rules issued that year. As in 2010 when there were 66 major rules, in the best of cases, OMB does not receive quantified benefits and costs for seven out of every 10 of the major rules they review (see chart below).

Drawing any conclusion from such a skewed data set is highly questionable at best.

3. Oversight by OIRA is insufficient.

At the inception of OIRA in 1981, the executive branch regulatory agencies had total staffing of 115,047. In 2012, it is 248,965 for social regulation alone, and about 277,000 in the executive branch overall.[20] This is an increase of 240 percent. At the same time, the OIRA professional staff declined from about 77 at its inception to 50, a decline of 38 percent. In addition, only about 30 OIRA staff members work on regulations at any one time. In 1981, there were about 63,554 pages in the Federal Register; in 2011, there were 82,419 pages in the Federal Register, an increase of almost 30 percent.[21] So right now, 30 OIRA staff members are charged with examining the work of more than 270,000 people in the regulatory agencies.

OIRA staff members today review about 90 major (proposed and final) rules per year, about 600 non-major rules, and about 3,000 Paperwork Reduction Act requests each year.[22] These rules take time to review as many are quite large. The Mercatus Regulatory Studies Program looked at OIRA review times in the first three years of the George W. Bush administration and compared this data to the first three years of the Obama administration. We found that the average review time in both periods for economically significant regulations was 44 days. However, this number is misleading because the average is skewed upwards by a small number of rules with very long review times. In general, most regulations are reviewed in much shorter periods. For example, in the six-year period reviewed, nearly 15 percent of economically significant rules had OIRA review times under five days, 25 percent were reviewed in under 10 days, and nearly 38 percent were reviewed in under 20 days. In comparison, agencies may take five years or longer preparing rules before they publish a proposal.

Recent Mercatus research suggests that short review times may be related to lower quality analysis. In a new study by Jerry Ellig of the Mercatus Center and Chris Conover of Duke University, the authors found that eight interim final rules associated with the Patient Protection and Affordable Care Act issued by the Department of Health and Human Services (HHS) in 2010 had considerably lower quality analysis than previous rules issued by HHS. This may be related to the fact that these rules had an average review time of just five days.[23]

A FEW SOLUTIONS

Based on the evidence, continuing the status quo cannot change the incentives that cause agencies to place a low priority on quality economic analysis. There are options, however, that could get us better regulatory analysis and better regulations.

- Increase Government Oversight

As agency staffs have more than doubled, one could argue that OIRA’s staff should be doubled from its original capacity, from 77 to 160. More important, OIRA urgently needs more trained risk assessors so that it has sufficient capacity to critically review every aspect of benefits analyses, including risk assessments. To be useful, risk assessments must be compatible with benefit assessments, but too often they are either the wrong form, such as safety assessments (for example, reference doses, reference concentrations, or acceptable daily intakes), or they are conservative estimates of risk.[24] As with all analysis, risk assessments must be, to the extent possible, objective. In fact, they are expected to comply with the Data Quality Act, which says that agencies must ensure and maximize the “quality, objectivity, utility and integrity of information.” Objectivity refers to the fact that independent observers using the same procedures will come to consensus and that personal opinions, values, and biases will not change the outcome. OIRA must be in a position to evaluate the suitability and objectivity of risk assessments to determine their effect on the benefit side of the equation.

If staffing is to be increased, OIRA’s scope should also be increased to cover the increasingly active independent agencies whose economic analysis is either absent or has been repeatedly found to be poor (for example, the Securities and Exchange Commission).[25]

In addition to needing more staff, OIRA needs to adjust its review time as some rules appear to be rushed through the process. A minimum review time should be placed on economically significant rules so that OIRA has sufficient time and resources to review economically significant regulations. A minimum of at least 60 days should be required to review those rules that have an impact of $100 million dollars or more on the economy. This reform should help ensure that regulations are well informed by quality economic analysis before agencies move forward with a final regulation.

Finally, an alternative to giving OIRA more staff is to create an independent office to either prepare analyses for the Executive Branch or to act as a second set of reviewers after OIRA.

2. Open the Process Earlier

OIRA has tried for many years to get agencies to come to OIRA early in the process to discuss proposals. The reason, as is well known, is that by the time agencies have produced a proposal, an enormous amount of work has gone into it and the decision is normally on a conveyor belt to final rule. The game that some agencies play with OIRA is to throw some things in their proposals that they don’t care about. This allows OIRA to have some small victories in eliminating costly or ineffective provisions while the agencies keep their true proposals largely intact. As mentioned above, there is very little time for OIRA to review these rules, and agencies will typically dig in their heels to prevent significant changes to their rules. Besides giving OIRA more time and staff to review rules, give OIRA advanced notices for economically significant rules.

This kind of advanced notice would include the definition and evidence of the systemic problem the agency intends to address, along with some possible ways of solving the problem and a preliminary estimate of the benefits and costs of those alternatives. This would give both stakeholders and OIRA analysts a chance to weigh in early before agencies have cemented their position.

3. Increase Oversight by Stakeholders

One way to increase oversight would be to allow for “crowd sourcing.” Crowd sourcing refers to groups of people who, for any given issue, have significant information that should be factored into the decision. Currently, the only option open to people with this kind of information is to submit comments to the agencies. However, they cannot challenge the agency if the agency simply disagrees with them. Relying only on OIRA is not likely to work as OIRA faces the challenges of being too small and not being able to comment on politically sensitive rules. If the analyses were judicially reviewable, then stakeholders with knowledge of benefits and costs could challenge the agencies in court.[26]

CONCLUSION

Every president has struggled to improve his management of agency regulatory authority. For 30 years, OIRA has served as a gatekeeper with limited authority. Six administrations have supported the use of quality economic analysis to inform regulatory decision-making. Simply restating this principle in executive orders and public statements has not and will not achieve the objective, all good intentions notwithstanding. Without definitive action, we risk doing the same thing over and over again expecting different results, an approach that Albert Einstein logically concluded to be the definition of insanity.

Footnotes

[1]This testimony reflects only the views of its author and does not represent an official position of George Mason University.

[2]Elena Kagan, “Presidential Administration,” Harvard Law Review 114 (2000-2001):2272–73.

[3] Ibid.

[4]Williams, Richard A., “The Influence of Regulatory Economists in Federal Health and Safety Agencies,” Mercatus Working Paper, July 2008.

[5] Worse, despite the decade-old requirement of the Government Performance and Results Act, agencies rarely are able to articulate the progress they are making at solving the problems under their purview.

[6] Barack Obama, “Toward a 21stCentury Regulatory System,”Wall Street Journal, January 18, 2011.

[7] Executive Order 13563, Improving Regulation and Regulatory Review, January 18, 2011.

[8] Cass Sunstein, Testimony before the Committee on the Judiciary, Courts, Commercial and Administrative Law Subcommittee, U.S. House of Representatives, July 27, 2010, http://judiciary.house.gov/hearings/pdf/Sunstein100727.pdf /.

[9]OMB, Report to Congress on the Costs and Benefits of Federal Regulation, September 30, 1997, http://www.whitehouse.gov/omb/inforeg_chap2#taop /.

[10] The latest report is 2011 Report to Congress on the Benefits and Costs of Federal Regulations and Unfunded Mandates on State, Local, and Tribal Entities, found at http://www.whitehouse.gov/sites/default/files/omb/inforeg/2011_cb/2011_cba_report.pdf /.

[11] Sally Katzen, Testimony before the Committee on the Judiciary, Courts, Commercial and Administrative Law Subcommittee, U.S. House of Representatives, May 4, 2011.

[12] Williams, Richard A., “The Influence of Regulatory Economists in Federal Health and Safety Agencies,” Mercatus Working Paper, July 2008.

[13]Ellig, Jerry and John Morrall, “Assessing the Quality of Regulatory Analysis,” Mercatus Working Paper, December 15, 2010.

[14] See, for example, Winston Harrington, “Grading Estimates of the Benefits and Costs of Federal Regulation: A Review of Reviews,” (Discussion Paper 06-39, Resources for the Future) and Robert W. Hahn and Paul C. Tetlock, “Has Economic Analysis Improved Regulatory Decisions?” Journal of Economic Perspectives, 22 no.1 (Winter): 67–84.

[15] See, for example, James Broughel and Jerry Ellig, “Regulatory Alternatives: Best and Worst Practices,” Mercatus on Policy, February 21, 2012.

[16]Susan Dudley, cited in “The Rule of More,” The Economist, February 18, 2012. See also, Michael L. Marlow and Sherzod Abdukadirov, “Fat Chance: An Analysis of Anti-Obesity Efforts,” Mercatus Working Paper, March 1, 2012.

[17] National Research Council of the National Academy of Sciences, “Review of the Environmental Protection Agency’s Draft IRIS Assessment of Formaldehyde,“ May 2011, p. 4, http://books.nap.edu/catalog.php?record_id=13142#toc /.

[18]Richard A. Williams and Sherzod Abdukadirov, “Regulatory Monsters,” Regulation Magazine, 34 no. 3 (Fall 2011).

[19]Government Accountability Office, “Analysis of OMB’s Reports on the Costs and Benefits of Federal Regulation” (GGD-99-59) April 20, 1999, p.5.http://www.gao.gov/products/GGD-99-59 /.

[20]Susan Dudley and Melinda Warren , “Fiscal Stalemate Reflected in Regulators’ Budget: An Analysis of the U.S. Budget for Fiscal Years 2011 and 2012,” Regulator’s Budget Report (Weidenbaum Center on the Economy, Government, and Public Policy Washington University St. Louis, and Regulatory Studies Center Trachtenberg School of Public Policy and Public Administration, The George Washington University Washington, DC), 33 (May 2011).

[21]Office of the Federal Register, www.llsdc.org/attachments/wysiwyg/544/fed-reg-pages.pdf.

[22]Curtis W. Copeland, “Federal Rulemaking: the Role of the Office of Information and Regulatory Affairs,” Congressional Research Service Report for Congress RL32397, June 9, 2009.

[23]Conover, Chris and Jerry Ellig, “Rushed Regulation Reform,” Mercatus on Policy, January 9, 2012, http://mercatus.org/publication/rushed-regulation-reform ; Conover and Ellig, “The Poor Quality of Affordable Care Act Regulations,” Mercatus on Policy, January 9, 2012, http://mercatus.org/publication/poor-quality-affordable-care-act-regulations ; Chris Conover and Jerry Ellig, “Beware the Rush to Presumption, Part A,” Mercatus Working Paper, January 9, 2012, http://mercatus.org/publication/beware-rush-presumption-part ; Conover and Ellig, “Beware the Rush to Presumption, Part B,” Mercatus Working Paper, January 9, 2012), http://mercatus.org/publication/beware-rush-presumption-part-b.

[24]Richard A. Williams and Kim Thompson, “Combining Risk and Economic Assessments While Preserving the Separation of Powers,” Risk Analysis, 24 no. 6 (2004).

[25]Sarah N. Lynch and Christopher Doering, “Analysis: Bruised regulators brace for Dodd-Frank Court Fights,” Reuters, August 4, 2011, http://www.reuters.com/article/2011/08/04/us-financial-regulation-courts-idUSTRE7730K220110804

[26]Williams, Richard A. and Sherzod Abdukadirov, “Blueprint for Regulatory Reform” Mercatus Working Paper, February, 2012, http://mercatus.org/sites/default/files/publication/Blueprint_For_regulatory_Reform.pdf /.